Everyone that drives for Doordash should be tracking their miles due to a tax writeoff they receive for every mile driven while working for Doordash.

Does Doordash track your miles? Doordash does not have a feature to track the mileage driven by delivery drivers. However, you can use a third-party GPS tracking app to track your miles while driving for Doordash.

There are a few different GPS apps that you can use, and we’ll go over a couple of them below.

This article will focus on why you should track your miles and how to track your Doordash miles.

How to Track Miles on Doordash

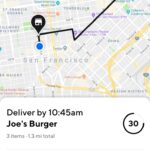

Doordash does not have a native feature that tracks your cumulative miles. It does track the miles on each delivery, so you can manually add the mileage from each individual delivery to get your cumulative total.

That’s cumbersome and very inefficient, though.

This is why Doordash drivers almost always use a third party app to track their miles. Doordash has a partnership with Everlance, but it costs $5 per month if you want more than 30 tracked trips per month.

Some other third party apps that can track your mileage include:

- Triplog

- MileIQ

- Stride

Stride has a fairly comprehensive free plan, which makes Stride the best free mileage tracker for Doordash. The paid options typically cost from $5 to $10 per month.

Can You Track Doordash Miles With a Pen and Paper?

Yes, you can track your Doordash miles with a pen and paper. It’s a little cumbersome and inefficient, but the IRS does accept handwritten mileage logs. All you need to do is record the miles you started the drive with, finished the drive with, and other information about the delivery (addresses) in a notebook.

It’s not recommended to use a pen and paper to track your mileage, though. It greatly increases the odds of making a mistake and adds more time to your trips. Time is money with Doordash, so you want to do everything possible to reduce the time spent on orders.

Why You Should Track Your Doordash Miles

There is one reason you should track all the miles you drive for Doordash – you can write off all the miles driven for Doordash as an expense on your tax return ($0.52/mile).

The average Doordash driver earns about $1/mile driven, so they can write off the majority of their earnings just from the mileage driven.

There is one important thing to note about claiming miles on your tax return. If you claim too many miles on your taxes, then you greatly increase the chances of an audit. It’s recommended to follow the rules for claiming miles – only claim miles that you drive for work. Don’t put your personal miles down as Doordash miles as that greatly increases your chances of an audit.

Final Thoughts

Doordash tracks driver miles. However, the app does not have a way for drivers to access their cumulative miles driven and can only see the miles they drive on each delivery.

Due to this, most drivers use a third party app to track their miles for tax purposes. Some of the options available include Everlance, Triplog, and Stride.