Suppose you’re interested in becoming a part of the DoorDash company and getting a job as a dasher. This is a decent job to earn some cash on the side by doing deliveries. However, you might be interested in figuring out how you will have to regulate your taxes as their employee. Is DoorDash a sole proprietorship or an individual business? This article is here to explain this dilemma.

DoorDash is considered to be a sole proprietorship because its employees work as independent contractors. This company can also be considered as the individual business type since they own an unincorporated business. They will not automatically withhold state or federal income taxes, so their employees have to keep track of their earnings and pay taxes themselves.

DoorDash Can Be Considered a Sole Proprietorship

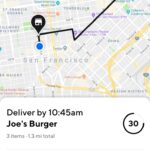

DoorDash is an American company based in San Francisco, California that operates online food ordering. Being the largest food delivery company, it attracts a great number of people who wish to work and earn money working as dashers.

If you are currently interested in finding out more about being employed in the DoorDash company, figuring out some legal issues, and finding information about what type of business this company is should be on your to-do list. Most dashers operate as sole proprietors, so unlike with an LLC or S-corp, there is no legal structure to their actual work.

Is DoorDash a Sole Proprietorship or an Individual?

Once you’re filling out the form on Payable in order to get your 1099 for Instacart, you might be confused about whether this business is a sole proprietorship or an individual. The DoorDash company does not stress too much about this question. Both individual and sole proprietor are correct answers to “Business Type.” According to the IRS, it is a sole proprietorship – someone who owns an unincorporated business by himself or herself.

How Do Dashers Pay for Their Income Taxes?

DoorDash is an independent contractor, meaning it won’t automatically withhold state or federal income taxes. As a dasher, you will be responsible for keeping track of your earnings, calculating your taxes, and paying them. There are two options for paying taxes as a dasher.

One option is to use Form 1040, which helps get your personal tax return by writing off business expenses in the section called Schedule C. This is an option most individual businesses choose to do in order to regulate their taxes. Another option is the 1099-K form which is usually provided by companies that offer an app facilitating peer-to-peer activities, like freelance work or ridesharing.

According to DoorDash regulations, only restaurant partners who have earned more than $20,000 in sales and done 200 or more transactions (deliveries) during the previous year are provided with the 1099-K form.

What Is Reported on the 1099-K Form?

Per Internal Revenue Service guidelines, Gross Volume is processed through the TPSO (Third Party Settlement Organization), which is, in this specific case, the Subtotal and Tax on orders processes. You should note that the amounts on the 1099-K are not equal to the payments actually made by DoorDash to the Merchant, as they are not adjusted for refunds, commissions, or any other adjustments.

The forms will be delivered to you either as a paper copy through mail or e-delivery through Stripe Express. Keep in mind that Stripe won’t provide you with an additional mailed copy if you select e-delivery. There are a few important dates regarding filing for taxes, so it’s best that you write them down in your calendar.

| Date | What’s happening? |

| By January 31st | Dasher 1099 forms are available via Stripe Express or mailed out for dashers who did not opt for e-delivery |

| By February 14th | Dashers who did not opt for e-delivery forms received their 1099 through Postal Service |

| By February 28th | Dasher mileage was sent out to all Dashers in a specific order |

| April 18th | Last day to file taxes. Just in case, check IRS sources for the most accurate information |

What Write-Offs Can You Deduct as a Dasher?

Now that you know what 1099-K is and how to file your taxes, you might wish to learn how to get the lowest possible tax bill by writing off your business expenses. Whether you are a side hustler or a full-time dasher, keeping track of your write-offs is super important and should not be neglected.

Most people who are employed in the delivery business use one card for everything they spend on their work and one card for their personal expenses. Even though there are some useful advantages of using this method, for most dashers, it’s not quite realistic.

If you cannot have a separate business card, you can make bookkeeping easier by using certain apps for tracking expenses. Usual expenses which you can write off with this method are:

- Gas,

- Car repairs,

- Car insurance,

- Auto loan interest,

- Parking fees,

- Tolls,

- Car maintenance,

- DoorDash commission fees.

Is Working In DoorDash as a Dasher Profitable Job?

Driving for the DoorDash company is a way of earning some decent income and cash on the side, and it is a job that definitely has its own perks. It is considered a good part-time job since you can create your own schedule and earn a larger amount of money. However, not a lot of people believe that this position can be a steady job.

Even though you can control your earnings, being an independent contractor can also be a bit stressful and even unprofitable. After all the expenses you will go through, you may not net as much as it’s usually advertised. However, this depends on your job preferences and how much you enjoy the job you do.